Stockholm, 28th February 2023 – Klarna, the global leader in the generational shift away from credit cards, released its fourth quarter results and its full year annual report for 1 January to 31st December 2022 demonstrating significant growth and progress towards profitability, with strong US market performance. The full earnings release has been made available on the Company’s Investor Relations website.

Sebastian Siemiatkowski CEO of Klarna said, “Through a challenging macro environment we have once again proven our resilience delivering high profitability across our established markets while launching products and services helping to diversify our revenues and solving problems for consumers. With GMV up 22% YoY and credit loss rates decreasing, we have made significant progress on our new strategy and we’re on a solid path towards profitability. In December 2022 the US became our largest market by revenue, with GMV up 71% YoY, and we’re adding real value to our growing fanbase of over 150 million consumers every day. We’re committed to accelerating commerce and making shopping an enjoyable, worry-free experience for everyone.”

GROWTH

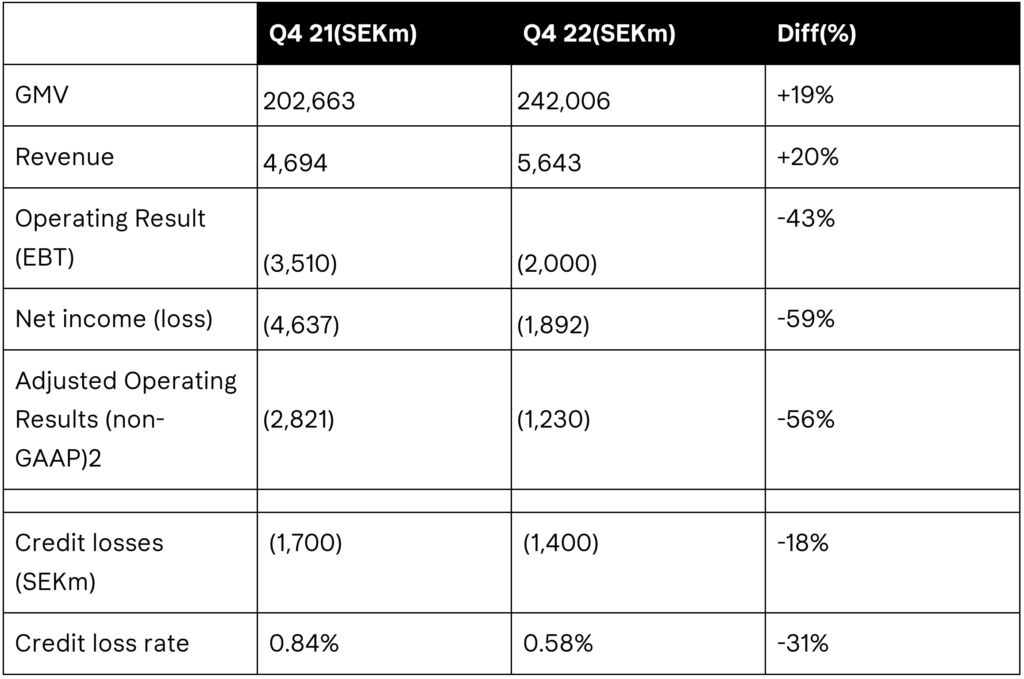

Klarna continues to grow faster than the market in a challenging macro environment. While ecommerce remained flat1, the value of goods purchased through Klarna (Gross Merchandise Volume (GMV)) grew by 19% in Q4 2022 compared to the same quarter in 2021, driving an increase of 20% in revenue over the same period. Klarna made further progress in diversifying revenue, with marketing revenue up +131% in 2022, accounting for 10% of total global revenue in Q4 2022.

At the same time, Klarna continues to invest in products and services, expanding features to better help consumers save time, money and worry with the launch of search, loyalty card wallet, and digital receipts. Klarna continued to help consumers make decisions about the environmental impact of their purchases with the launch of an enhanced CO2 tracker and conscious collections. Global purchase frequency increased by 23% in FY22 as Klarna becomes an intrinsic part of people’s lives, building a strong platform for future growth as a shopping destination of the future.

PROFITABILITY

In May 2022, Klarna was one of the first global businesses to realign its business to the new macro-economic environment. These changes are now showing results with adjusted operating results improving 21% (SEK 330m) in just one quarter while H222 improved an impressive 44% compared to H122.

The business has shown clear progress towards profitability, by simultaneously driving growth while reducing credit losses and costs. As Klarna’s business model is based on providing very short term loans, any changes to its underwriting policy are fully reflected in 70% of the balance sheet within three months. The changing macro-economic environment in 2022 provides a perfect case study for the company’s agility, as Klarna began tightening underwriting from May and by Q4 had reduced credit losses by 18% or SEK 300m compared to the same quarter in 2022. Compared to Q4 2021 Klarna improved its credit loss rate (credit losses / GMV) by 30% to an industry-leading 0.58% in Q4 2022.

STRONG US MARKET PERFORMANCE

Klarna continues to revolutionize retail banking while accelerating commerce in 45 markets, establishing a leading position in the US. As the second largest domestic ecommerce market behind China, the US is a key market for any global payments provider and in December 2022, it became Klarna’s largest market by revenue. In 2022, many large US retailers joined Klarna including Samsung, Groupon, Booking.com, Instacart, Tractor Supply Company and Fossil Group. 34 million Americans are now Klarna customers. Klarna continues to succeed in every market it enters and the US is no exception. Klarna’s underwriting continues to improve leading to a reduction of credit loss rates of 37% YoY while GMV grew by 71% in the same period – demonstrating our ability to maintain growth while reducing credit losses.

Klarna – Key Performance Indicators Q4 2022

Footnotes

2 Adjusted operating results are defined as IFRS operating results, excluding restructuring costs, share-based payments, related payroll taxes, depreciation and amortization.